|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

|

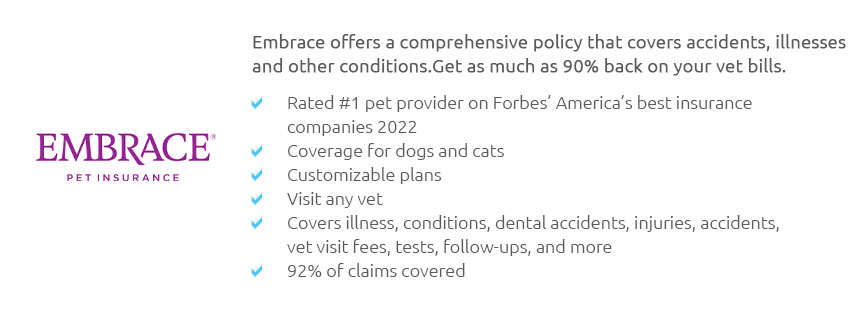

Best Pet Insurance in Pennsylvania: A Comprehensive GuideWhen it comes to ensuring the well-being of our beloved furry companions, choosing the right pet insurance can be a daunting task. With a multitude of options available, each offering a unique set of benefits and coverage levels, pet owners in Pennsylvania often find themselves overwhelmed. However, understanding the nuances of pet insurance can not only safeguard your pet's health but also provide financial peace of mind. In the heart of Pennsylvania, where pet ownership is a cherished tradition, selecting the best insurance involves considering several factors, from coverage specifics to customer service quality. Many pet owners tend to focus on affordability, yet it is equally crucial to examine the scope of coverage provided. A common mistake is opting for the cheapest plan without delving into what it actually covers. Does it include routine check-ups? Are emergency surgeries covered? What about hereditary conditions? Among the top contenders in Pennsylvania, Healthy Paws stands out for its comprehensive coverage and excellent customer service. Unlike some competitors, Healthy Paws offers a no-cap policy on annual or lifetime payouts, meaning your pet's medical needs are prioritized without worrying about hitting a financial ceiling. Furthermore, their swift claim processing and user-friendly mobile app make managing your pet's health expenses less cumbersome. On the other hand, Embrace Pet Insurance is often lauded for its customizable plans, allowing pet owners to tailor their coverage according to their specific needs. This flexibility is particularly beneficial for owners of pets with pre-existing conditions, as Embrace offers a diminishing deductible feature, which decreases annually if no claims are made. Another notable mention is Trupanion, especially favored by those with breeds prone to genetic disorders. Trupanion’s direct payment option to veterinarians is a significant advantage, eliminating the need for out-of-pocket expenses and subsequent reimbursement waits.

Ultimately, the best pet insurance in Pennsylvania is one that aligns with both your financial situation and your pet’s health needs. While it is tempting to rely on online reviews, it's advisable to consult with your veterinarian, who can offer insights based on their professional experience with different insurance companies. Remember, investing time in selecting the right insurance plan is akin to investing in your pet's future. In conclusion, pet insurance is not a luxury but a necessary component of responsible pet ownership. By considering the aforementioned factors and exploring the offerings of top providers like Healthy Paws, Embrace, and Trupanion, you can make a well-informed decision that ensures your pet receives the best possible care without financial strain. https://www.healthypawspetinsurance.com/locations/pa/pennsylvania-pet-insurance

The Healthy Paws pet insurance plan is designed with straightforward and simple terms of coverage, we reimburse covered claims quickly, and you can count on us ... https://www.petinsurance.com/whats-covered/pennsylvania/

All pet owners want the best for their furry family members. Find the right plan for your dog, cat, or exotic pet. Whether you live in Philadelphia, ... https://www.reddit.com/r/philadelphia/comments/v0g0z9/recs_for_pet_insurance_providers/

From someone who spends her time on the other side of the exam table, I usually recommend Trupanion, Healthy Paws, and Pumpkin. Make sure they ...

|